Have you ever sat down and considered the affordability of your debt and whether the short term loans, student loan or any other type of finance you're borrowing is good debt or bad debt? How much thought do you put into the cost of that debt and whether there is a better alternative? Do you ever sit down and actually work out how much everything you borrowed would cost to pay back over its total term and do you ever just pay extra off to reduce the term and cost of your debts?

It’s no secret that at some point we will almost all need debt in one form or another be it Wonga short term loans or a more long term financing option like a house or car payment. The first step to effective management of debt is understand the ‘good’ and the ‘bad’. These good debts are often perceived entirely differently from bad debt, like buying a home or paying for a university education.

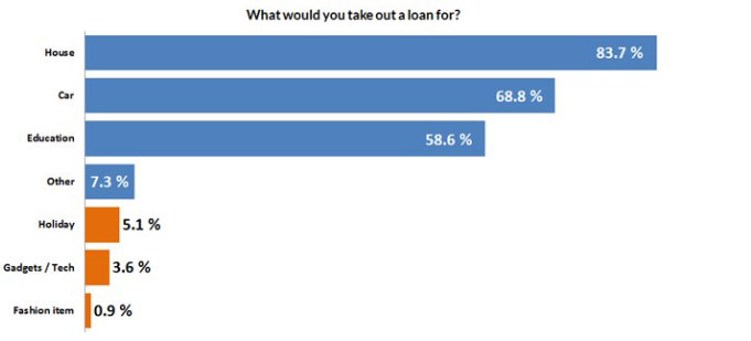

In fact, our recently completed ‘financial literacy’ survey of over 18,000 Wonga South Africa short term loan customers revealed that 83.7% of people surveyed said they would take out credit to buy a house whilst 58.6% of those surveyed said they would take out credit for university education. On the other end of the scale and the “not so good” debt: 5% would borrow for a holiday and 4.5% for gadgets, technology or fashion.

The evidence shows that South African customers are taking on debt in areas we consider ‘bad debt’, something we don’t recommend. Before you consider borrowing anything from us, or anywhere else, we suggest you consider three fundamental questions:+

- What’s it for?

- Can you afford it?

- What will it cost you?

What is the money for?

When you instinctively reach for your credit card, take a moment and think - what are you using it for? Do you need to use it or is your mentality one of ‘positive spending’ through a loyalty points programme for example? Those points are nice, but not if they’re outweighed by the cost of interest on your spend.

Do you pay your credit card off within the interest free period so that you don’t get charged interest? Now this isn’t classed as either good debt or bad debt, in reality it’s considered as a ‘grey area’. This means it’s difficult to classify this type of debt as there are often additional elements that can make it good or bad. For example, it can depend on how much the loyalty scheme is worth and whether or not you do pay it off before the interest outweighs the value of the rewards.

If you are taking out a loan to pay your way through university then this is considered to be good debt. After all you are putting yourself through university tertiary education to improve yourself and ultimately increase your earning prospects. Likewise with the purchase of a house, the money you borrow to buy a house or property is also seen as good debt. It may be a home for yourself or an investment purchase that will (if chosen wisely) pay for itself and earn you profit. A lot of people now choose to lease cars rather than lose the money off the bonnet as soon as it is driven off the forecourt. This is seen as credit but probably falls somewhere in between good and grey! On the other side of the scale going to the nearest shopping centre and treating yourself to the latest fall fashion collection is definitely a bad use of debt though.

Can you afford to repay it?

It’s commonly advised that your total debt repayments should ideally not be more than 35% of your take home salary. Any more than this combined with your cost of living expenses and you simply wouldn’t be able to afford the necessary bills let alone those little extras. It is all well and good using the credit card to pay for the things you can’t afford one month but what about the following month when you then have to repay the credit card debt? We recommend checking out the average cost of living for your area (here’s a breakdown of Cape Town's average costs to get you started) and compare this with your own monthly budget. If you’re struggling to gain a bird’s eye view of your monthly spending then check out our free budget planner template. We also recommend exploring the new repayment options we offer with our personal loans as these provide greater flexibility for customers via monthly repayments. With Wonga, new customers can repay up to 3 months, and existing customers can repay up to 6 months.

Cost to repay it

How much will the debt cost in total? What are the interest payments and how much will you end up paying back over the term of the credit? If you have a credit card and you make the minimum payment each month the total you will end up paying back and the length of the term would probably shock you if you sat down and weighed it all up but we don’t always do that.

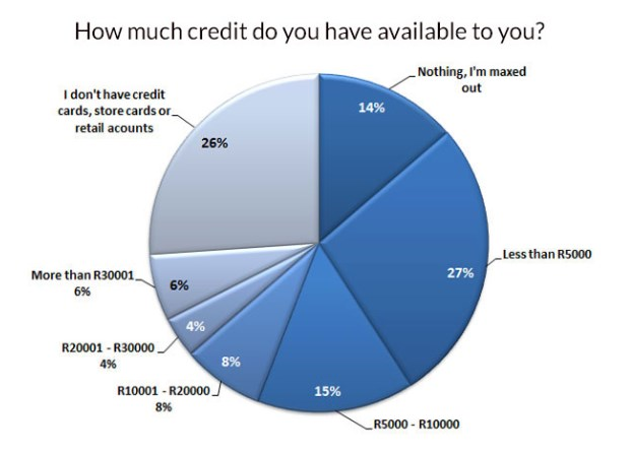

22.6% of our surveyed audience said that although they knew the cost of repaying the debt, the need for the money outweighed the cost implications later in the month. Whilst 3% didn’t even look at the cost of repayment at all. More alarming figures showed that 13.7% have maxed out their current credit facilities with 27.2% of our survey group had less than R5K’s worth of credit available to them.

You may be struggling with a significant debt that keeps you awake at night, or you may have things firmly under your control. In either case, the right attitude to how you approach your finances can make all the difference if you find yourself with an unexpected expense. The ability to fall back on savings as opposed to credit is reflective of a much more stable (and happy!) existence.

If you're interested in learning more, our guide to financial literacy explores the key concepts behind debt, savings, budgeting, and investing.

More from our blog: