You may have heard banks or other financial institutions talking about a credit score, and whether it’s high or low. But what exactly does this mean, and how does it affect your lending potential?

Unfortunately, many consumers are in the dark when it comes to their credit score, and don’t realise that a low score can negatively impact their ability to apply for credit.

What exactly is a credit score?

When you apply for credit of any kind, a credit check is done to determine what your score is. Based on this, lenders can determine what they can expect if they loan you money by looking at several things – such as will you pay them back on time, or how often is your credit card maxed out.

The higher your credit score, the less risk there is to the lender - so, it goes without saying that you want to build and maintain a healthy credit record. This is especially true when it comes to purchasing a home or vehicle.

More information on your credit score

How is a credit score calculated?

A credit score is calculated using information contained in your credit report, including account information, payment history, and public records and enquiries (as well as requests from other credit providers to view your credit record.) Your score is a summary of positive and negative factors that determines whether or not you’re likely to honour future credit agreements.

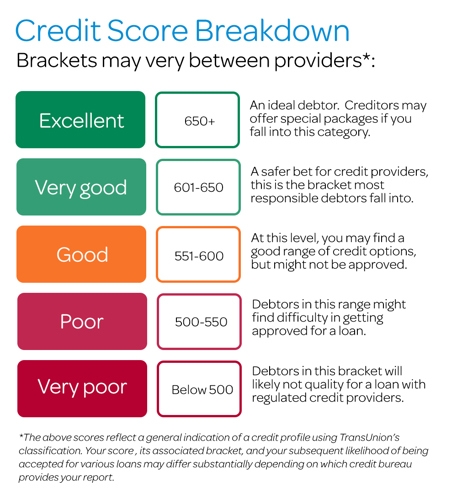

What’s considered to be a ‘low’ credit score?

How will a low credit score affect me?

If you have a low credit score, you may face restrictions on the condition of your loan, such as total loan amount, interest rate and repayment timeframes. Sometimes, you may even be declined when applying for credit.

Can I qualify for any loans with bad credit?

If you have a low credit score, your options may be limited, but doesn’t mean you can’t necessarily qualify.

Wonga will only approve your loan request if we believe you can repay your debt. If you have a low credit score or have faced difficulty in repaying loans in the past, it might be a good idea to step back and take another look at your finances.

If you’re ready to master your money, the Wonga Money Academy gives you the power to learn more about financial literacy. Why not review your knowledge of debt, saving, budgeting, and investing, and see where you could improve?

How to apply for a loan with a low credit score

If you have a low credit score and would like to try apply for a payday loan, the application process will usually be the same as someone with a normal credit score – however, the restrictions on what borrowing terms you are offered may be tighter.

In some cases, you may have to provide more information about your ability to repay.

What other options do I have if I can’t qualify for a loan with a low credit score?

Firstly, don’t keep applying for more credit – all credit applications you make (whether successful or not) do show up on your credit report.

Making many applications over a short period of time may hurt your chances as you can appear desperate for credit to lenders, as you may not have enough money to repay all the loans you may currently have.

If you’re looking for a loan or need extra cash, why not look at some alternative options instead?

- Develop a robust saving strategy

- Create a secondary income stream

- Find ways to improve your score before applying for credit again [link to improve your credit score]

Tips to improve your credit score

The good news is that if you have a low credit score, there’s a lot you can do to increase it – and it may not take long for your good habits to reflect on your report.

Generally, you can approve your credit score by:

- Paying your bills on time

- Paying the full amount that is owed each month on your account

- Ensure that you can afford the minimum repayments on any loans you take out

- Try not to use more than 30% of your existing credit facilities – such as your credit score.

Remember, at the end of the day your credit score is a reflection of your borrowing habits – and the best way to keep a good score is to practice borrowing responsibly.

Be sure to check your credit report at least twice a year to make sure there aren’t any errors or signs of identity theft.

With good habits and checks in place, you can build and maintain a good credit record that can put you in great stead when you next apply for a loan.

Useful tools to help your credit score

- The benefits of saving

- What can you do to help a friend in debt?

- What are debt traps, and how can you avoid them?

Read more from our blog:

- Five things that don't affect your credit score

- Common credit score questions answered

- Quick Loans with Wonga